Asia's High-Stakes Chip Game: What To Do When You're Caught Between Two Tech Superpowers

From Asia’s Vantage Point: Part Two of Our Expert’s Take on the Chip War

Before we dive into today’s story:

We’re excited to share that Asia Tech Lens has crossed 100 subscribers. It’s a small but meaningful milestone, barely a month since launch. Thank you for being part of this growing community curious about Asia’s tech evolution.

This week’s post is part two of Dr. Karan Srivastava’s opinion piece on the US-China chip war and its impact on Asia and the world. Dr Srivastava brings a unique perspective to technology industry discussions, combining deep financial services expertise with hands-on experience leading digital transformation initiatives across Asia’s most dynamic markets. He currently heads the digital transformation initiative and is a Chief Product Owner at a global bank. Dr Srivastava oversees enterprise-scale technology innovation, working directly with major technology partners including fintech and insurtech companies to integrate AI and predictive analytics into core business operations.

Currently based in Singapore - one of Asia’s leading technology hub - Dr. Srivastava witnesses daily how multinational corporations navigate rapidly evolving technology landscapes. His role requires constant evaluation of technology partnerships, AI implementation strategies, and digital platform evolution in an increasingly complex global tech ecosystem. From semiconductor dependencies to cloud infrastructure decisions, from AI model selection to data governance frameworks, he observes how technology choices ripple through entire industries

Remember being the new kid in school when two popular groups were feuding? Suddenly every lunch invitation became loaded with meaning. "Sit with us and you can't sit with them." "Choose our team for the project, or we won't work with you next time."

That's Asia right now - except instead of cafeteria politics, it's the U.S. and China competing intensely over semiconductors. And instead of picking sides for dodgeball, we're talking about the future of basically every piece of tech you'll touch for the next fifty years.

Singapore has become the perfect vantage point to watch this drama unfold. The contrast is stark - stressed Taiwanese chip designers dealing with impossible political pressures, Korean executives celebrating massive profit margins, and Indian entrepreneurs who see nothing but opportunity ahead. Everyone's got an angle. Everyone's got a plan. And honestly? Some of these strategies are absolutely fascinating.

So grab a coffee (or something stronger - you might need it), and let me tell you how different Asian countries are playing their hands in the highest-stakes poker game on the planet.

Taiwan: The Reluctant Kingmaker

Poor Taiwan. Imagine accidentally becoming the most important place on Earth for all the wrong reasons. This little island - smaller than Switzerland - somehow ended up making basically all the world's fanciest computer chips. TSMC pumps out over 90% of the most advanced semiconductors. Every iPhone, every AI server, every cutting-edge military system - they all need Taiwan's chips. It's insane.

Last November, things got real when Uncle Sam called TSMC and basically said "no more advanced chips for China." Not a request. An order. Stop shipping anything 7-nanometer or better that could help Chinese AI. Just like that. Bang.

Industry insiders report that the mood in TSMC's Hsinchu headquarters that week was "somewhere between panic and strategic reassessment." Here's a company that spent decades building relationships with Chinese customers, and suddenly they're being told to fundamentally restructure those relationships.

Taiwan's playing the "silicon shield" card hard - basically betting that being irreplaceable keeps them safe from invasion. Beijing responded strategically in April: new rules that basically say "if it's made in Taiwan, no tariffs. Made in America? Standard tariffs apply." It's a clever move to create economic incentives that favor Taiwanese manufacturers.

The craziest part? TSMC is spending $165 billion - billion with a B - building factories in Arizona. They want 30% of their top-tier production in America by 2030. Is it insurance? Is it strategic diversification? Nobody really knows.

South Korea: Playing Both Sides Masterfully

Okay, if Taiwan's the stressed-out overachiever, South Korea is that kid who somehow aces every test without breaking a sweat. Samsung and SK Hynix have 70% of the world's DRAM market and half of all NAND flash on lockdown. Memory chips might not be as sexy as processors, but guess what? Everything needs memory. Everything.

The Koreans pulled off something impressive last year. After months of diplomatic negotiations, they scored "validated end user" status from Washington. Sounds boring, right? Wrong. It means they can keep running their massive Chinese factories without seeking individual licenses every quarter.

Here's why this matters: Samsung makes 40% of its NAND in Xi'an. SK Hynix has 40% of its DRAM production in Wuxi. Shutting those down would be corporate suicide.

But they're not naive. Both companies stopped selling their used equipment because they understand it might end up in unintended applications. They're literally sitting in warehouses full of old machines they could sell for millions. But they won't.

The payoff? Holy hell. 854% profit increase in 2024. Not revenue. Profit. Korean semiconductor executives are celebrating like never before. "While others compete," one executive was overheard saying, "we serve all markets." The strategy might just be genius.

India: The Understudy Ready for the Spotlight

India saw this situation developing and thought "our time to shine." They're not trying to out-Taiwan Taiwan or directly challenge China's manufacturing scale. They're playing a different game entirely: "Hey West, need a democracy that speaks English and offers reliable partnership? We're right here!"

The India Semiconductor Mission - $10 billion of "please bring your chip factories here" money - is working better than anyone expected. But the real coup was landing Micron's $2.75 billion facility. First major US memory maker to set up serious operations in India. Ever.

The Gujarat construction site is impressive not just for its scale - it's the energy. Engineers who studied at MIT and Stanford are returning home to build something massive. As one returnee put it, "My parents left India for opportunity. I'm coming back because the opportunity is here now."

India's pitch is brilliant in its simplicity. They're not promising to be the cheapest or the most advanced. They're promising to be a reliable partner. In a world where everyone's concerned about supply chain security and technology transfer, "reliable partnership" is worth its weight in gold.

Southeast Asia: Benefiting from Strategic Competition

This is where it gets interesting. While the superpowers compete intensely, Southeast Asia is strategically positioned to benefit from both sides' investment flows. Singapore, this beautiful, expensive city, has turned being neutral into an art form. Chips are 7% of GDP. It's like that friend who maintains good relationships with both sides of a complex situation.

Walking through one-north (our tech district), you'll see American chip designers in one building and Chinese AI companies in the next. They probably eat at the same hawker center. It's remarkable how well this coexistence works.

Malaysia went a different route, they control 13% of global chip testing and packaging. Not the most glamorous part of the value chain, but absolutely essential. You can design the world's best chip, but someone needs to test it and put it in a package. That's Malaysia.

"Let Singapore have the designers," Malaysian officials say at conferences. "Let Taiwan have the fabs. We'll be the ones ensuring it all actually works."

The challenge? Talent. Singapore keeps attracting Malaysia's engineers with higher salaries. Vietnam needs something like 50,000 more engineers by 2030. You can build factories, but you need skilled humans to run them. Turns out that's the hard part.

The Machine Makers: Caught in the Middle

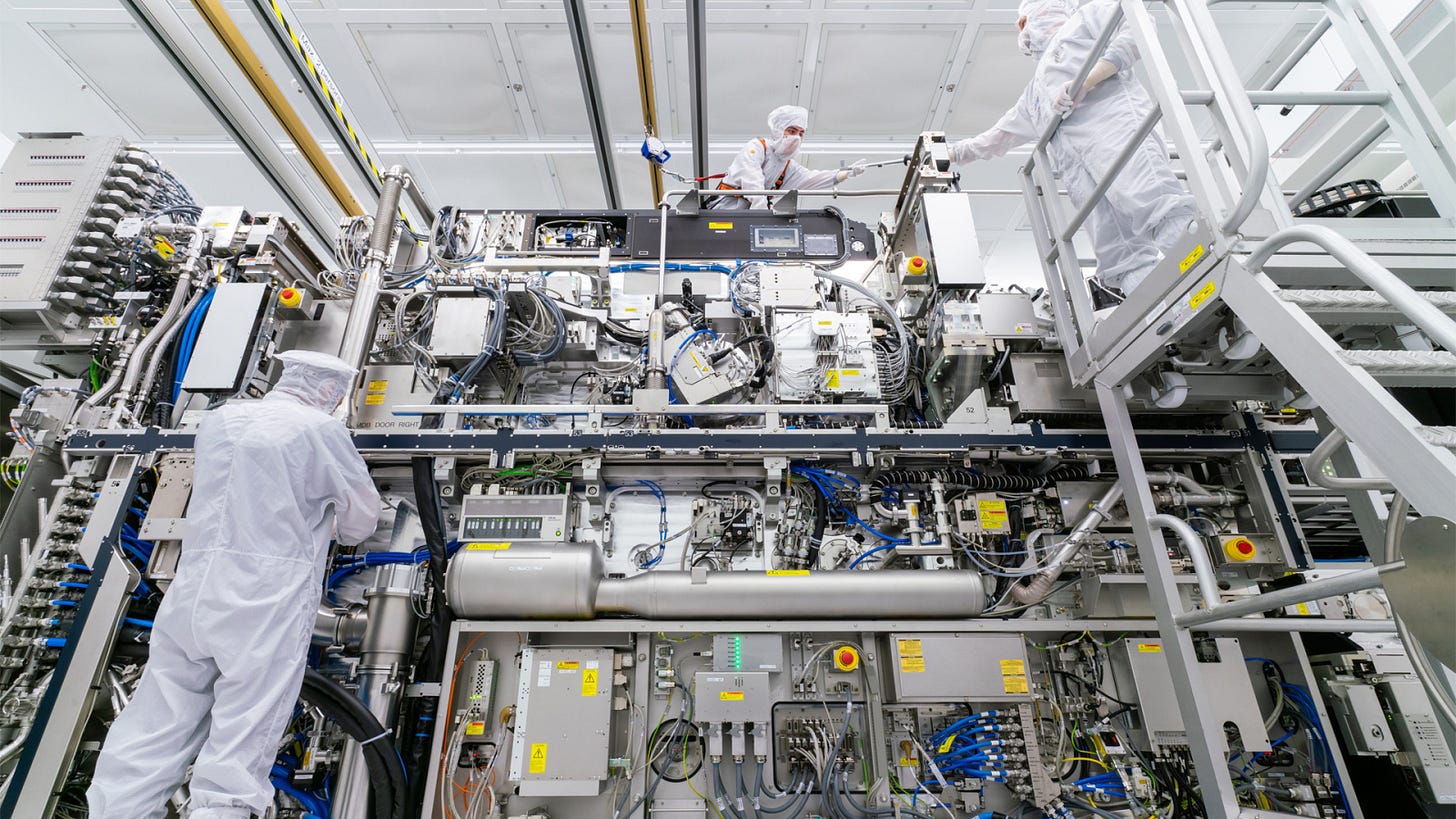

Now let's talk about ASML and the Japanese equipment makers. These companies just wanted to make incredibly sophisticated machines that manufacture incredibly tiny components. Now they find themselves at the center of geopolitical tensions.

ASML faces particular challenges. They make the only EUV machines on Earth. These things cost $200 million each and are the size of a bus. Without them, you can't make cutting-edge chips. Period.

The Dutch got drawn into this somewhat reluctantly. First they restricted EUV sales to China. Then America requested broader restrictions, so the expanded controls to include older DUV machines too. China responded with formal diplomatic protests and concerns about market access.

Japan faces similar challenges but has more companies to distribute the impact. Their controls on 23 types of equipment attempt to maintain diplomatic neutrality while addressing security concerns. China's response has included strategic discussions about rare earth mineral exports - particularly relevant for Japan's automotive industry.

What This All Means (Spoiler: It's Complex)

Observing from Singapore in 2025, this whole situation feels like living through that old saying: "May you live in interesting times." Brother, these times are fascinating.

We're watching the gradual reorganization of a global system that took fifty years to build. Instead of one integrated semiconductor ecosystem, we're seeing the emergence of multiple, somewhat separate technology spheres with different rules and partnerships.

For some countries, this creates challenges. If you can't navigate between different systems, you face difficult choices. But for the strategically positioned? The ones playing multiple angles effectively? There are significant opportunities.

The winners aren't necessarily the ones pledging exclusive loyalty to Washington or Beijing. They're the ones saying "Hey, America, we can help build your secure supply chain!" while also maintaining "China, we value our economic partnership!" It's pragmatic rather than ideological.

The Asian tech scene has been transforming rapidly since 2015. But this fundamental restructuring of global technology relationships? This is historically significant. And it's just getting started.

Every CEO and government official interviewed says some version of the same thing: "We're preparing for a world with multiple technology ecosystems." Not hoping for it. Not trying to prevent it. Preparing for it.

The semiconductor competition isn't coming. It's here. And Asia - pragmatic, adaptive, opportunistic Asia - is figuring out how to not just survive but thrive in this evolving landscape.

*The views expressed in this article are solely those of the author and do not reflect the views of any affiliated organizations or employers.

Insightful and well-researched! This article does a great job of highlighting the complex dynamics shaping Asia’s semiconductor ambitions. The coverage of Taiwan, China, and emerging players like Vietnam and Malaysia shows how the chip race is no longer just about technology.. It’s all about strategy, resilience, and global influence. A must-read for anyone tracking tech geopolitics. Looking forward to more interesting content.

Very realistic situation explained. It seems world is in Bipolar condition with China emerging a dominating player in SC supply chain in raw materials and developing innovating new chips which are more powerful. Thanks for insight of the emerging war in SC sector.